Johannes Wessels

@johannesEOSA1

Small enterprise in South Africa is unimportant for the Government. Whilst there is lip service to creating conducive conditions for small enterprise, the Government ignores the reality of small formal firms disappearing at an alarming rate. Small enterprise is the canary in the coal mine of a toxic business environment: they die off first before the toxic conditions are lethal for large businesses.

Big Government favours Big Business (for tax income) or Big Labour (watering its socialist roots to ensure worker class loyalties). Small business cannot fulfil either these roles. The demise of small formal enterprises in South Africa (as recorded in SARS data) is indicative of an utter indifference by Government to the plight of small enterprise.

That raises two questions:

- Is the demolition of the small formal enterprise environment a strategy by Government to achieve its objective of radical racial economic transformation?

- Is it also a strategy to plug a hole in the leaking SARS ship since, from a VAT perspective, businesses with a turnover below R1 million is a drain on Treasury?

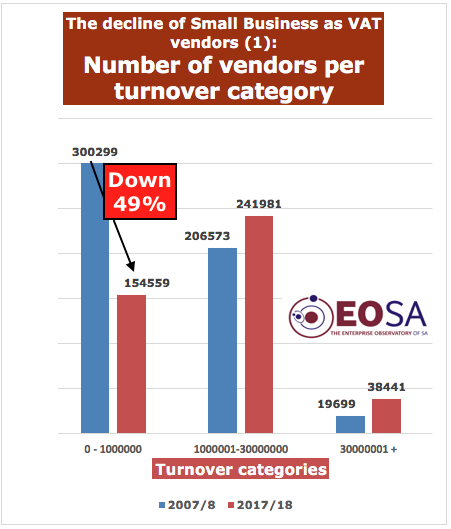

Based on SARS data on Value Added Tax (VAT) covering the years 2007/8 to 2017/18 the devastation on micro and small businesses with a turnover of R1 million or less, is evident. The number of VAT vendors in this bracket declined by 49% from 300 299 in 2007/8 to 154 559 in 2017/18.

145 740 small enterprises gone…

One could argue that the decline by 145 740 small enterprises was on the one hand due to entrepreneurial incompetence and inefficiency and on the other hand contributing to the increase by 54 150 VAT vendors in the larger turnover categories. This decline in numbers has nothing to do with the enterprise churn Schumpeter described as creative destruction. The overall decline rate of 17% in VAT vendors across all turnover categories makes it clear that small businesses are under far more strain than medium and large enterprises.

Shortly after his appointment as Minister of Finance, Tito Mboweni said “to get the economy performing, government needed to create an environment which allowed small and medium enterprises to operate at an optimum level. We must think in particular how to support small and medium enterprises. In Germany, the economy is driven by the hidden champions that are small and medium enterprises.”

He reiterated the common wisdom that small businesses are the best creators of jobs and economic growth. That, however, is a position of conviction, rather than of fact. For EOSA, the critical point in the large scale culling of small businesses (as evident from both SARS’s VAT and CIT data) is that it proves beyond doubt the existence of an enterprise unfriendly policy and operational environment. Small enterprises are effectively the canaries in the coal mine: they die off in a toxic business environment before the poison levels kill off large businesses…

When comparing VAT data from 2017/18 with that of 2007/8, from a turnover perspective, small enterprises with a turnover below R1 million registered a 57% decline from R91.7 billion to R52.3 billion whilst VAT vendors in the turnover category of R1 million – R30 million registered an increase of 39% from R1 071.4 billion to R1 487.9 billion with those with a turnover above R30 million registered an increase of 105% from R5 740.1 billion to R11 767.8 billion.

Without these small firms, SARS would have had billions more…

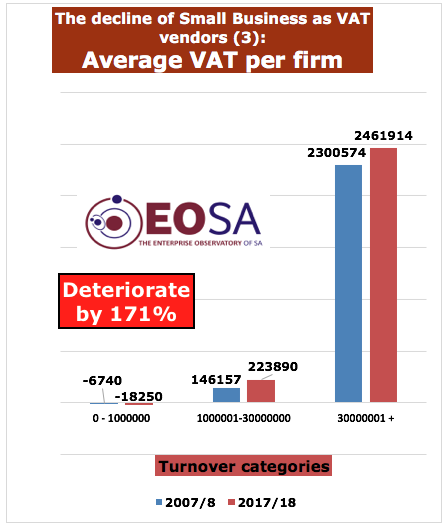

Concerning the nett VAT position (offsetting VAT collected and VAT refunds), it becomes clear why Government has a vested interest in ignoring the plight of small formal enterprise. In 2007/8 SARS had to pay the 300 299 VAT vendors with a turnover under R1 million an average refund per firm of R6 740 in excess of VAT collected. This situation deteriorated by 171% to an average of R18 250 refund per VAT vendor with a turnover under R1 million.

Were these businesses not in operation, SARS would have had R2.82 billion more in tax year 2017/18 by not having the nett VAT refunds for small VAT vendors. That amount is almost double the budget of R1.488 billion for the Department of Small Business Development. Government therefore would benefit from the demise of formal small businesses resulting in lower VAT refunds.

No company income tax would be collected if…

It is evident that the situation of the small formal enterprises has deteriorated significantly. The VAT data underlines the SARS data on Company Income Tax (CIT) about the dismal state of the private sector. CIT data showed that if all the companies in South Africa would have submitted a single joint amalgamated financial statement for tax purposes, Government would not have collected a cent in CIT for the tax years 2014 – 2016. During those years the assessed joint losses of all companies surpassed joint taxable income by R445 billion.

The CIT data also underlines the extremely precarious position of small formal enterprise with less than 1% of companies paying 85% of all company tax and the 19.7% of companies with taxable turnover below R1 million responsible for a mere 3.2% of CIT in 2016.

EOSA also pointed out that just in the financial and business services sector, SARS data indicated a decline of 83 000 companies registered for CIT.

These SARS data trends do not feature at all within the strategy of the Department of Small Business Development that is tasked with “leading an integrated approach” to promote and develop small businesses and cooperatives “through a focus on economic and legislative drivers that stimulate entrepreneurship to contribute to radical socioeconomic transformation”. EOSA could not find any reference to these data that demonstrates the predicament of small enterprise in either the departmental performance indicators of the DSBD or in discussions of parliamentary standing committees tasked with monitoring departmental progress and performance.

Will Ramaphosa be shocked again?

The mass establishment of small black businesses is also a central plank in Ramaphosa’s New Deal. Despite the fact that this approach was tested and tried with minimal effect during his stint as Deputy President, he is apparently unaware of the dismal failure of that approach.

Which raises the question: Is the real strategy one of turning a blind eye to conditions that undermine the viability of existing small businesses in order to open opportunities for state created black businesses, knowing well that the main sources of tax income from companies through CIT and VAT vendor income would not be harmed?

If so, the radical transformation of the small business component of the enterprise world could be achieved through a slash and burn approach rather than in growing the overall economy. That recalls the chilling words of Ramaphosa in March 2016 when he said he was “hell-bent” on radical economic transformation:

“For far too long this economy has been owned and controlled by white people. That must come to end. Those who don’t like this idea – tough for you. That is how we are proceeding.”

The next blog will deal with basic proposals on how to improve the toxic enterprise environment towards an enterprise-friendly environment that will benefit businesses in general.

(To receive an email alert of new blogs by Johannes Wessels, scroll to the bottom of the page and insert your email address)

Hi Johannes. Great article and many valid points. Just one thing not taken into account: The VAT registration requirement was lifted from R300k turnover p/a to R1m p/a in 2008. So in 2007 you had to be registered if over R300k, now only above R1m. So many businesses doing a turnover between R300k and R1m are not registered in 2018, while they had to be in 2008. This will account for majority of the drop referred to in your article.

LikeLike

Thanks Marnus. Indeed that factor contributed to the decline, just as graduation to higher turnover categories by some successful companies also played a role. Year by year data of VAT vendors indicate no sudden drop when the threshold was adjusted, rather a constant annual decline. (I’ve added a Figure indicating the year on year change in the article above). Whilst numerous VAT vendors are not companies or close corporations (e.g. sole proprietors or partnerships or trusts) data on Company Income Tax also indicate a drastic decline of small enterprises in numbers, see https://eosa.org.za/2019/04/04/sa-lost-83-000-companies-in-the-financial-business-sector-in-10-years/#more-2264 &https://eosa.org.za/2019/03/24/sa-enterprise-sector-critically-ill/

The thrust of the articles is simply: formal enterprises in SA operate in an anti-business rigged environment. Large companies can somewhat cope with it (but becomes less competitive internationally due these leg-irons) but formal small enterprises can’t. Their decline is indicative of a toxic environment for formal business.

LikeLike

Niice blog you have

LikeLike

Thanks Ingrid.

Please follow

Johannes

LikeLike