Johannes Wessels (@johannesEOSA1) & Mike Schüssler (@mikeschussler)

At the end of the initial 3 weeks lock-down a GDP decline of about 5% was considered as quite a catastrophic outcome. Even at that level, it was considered worth the price since delaying the spread of the Covid 19 virus would give a window of opportunity for the health sector to get beds, ventilators and care protocols in place for the spike that would inevitably come.

The minister of trade and industry (dti), Ebrahim Patel, however dismissed the negative projections of economic shrinkage as mere “thumb-sucking”.

After prolonging the hard lock-down with just a gradual easing to level 4 to end May, the growing queues of the hungry waiting for food parcels, the increase in the claims from the unemployment insurance fund and the drastic shrinking of the state’s purse, would make a 5% decline in GDP a dream outcome.

The GDP figures for Q1 2020 will only be known end June. Data from other countries indicate that those whose governments had opted for a hard lock-down are in for excessive economic damage.

Change in GDP trend is the difference between growth in 2019 and 2020 1st quarters, implying that the Philippines that experienced a change of -6% went from 5.9% GDP growth in Q1 2019 to -0.1% in Q1 2020. This chart reveals the following:

- Countries with a hard lock-down that kept only essential services and providers open, saw an average decline of 5,2% in GDP trend.

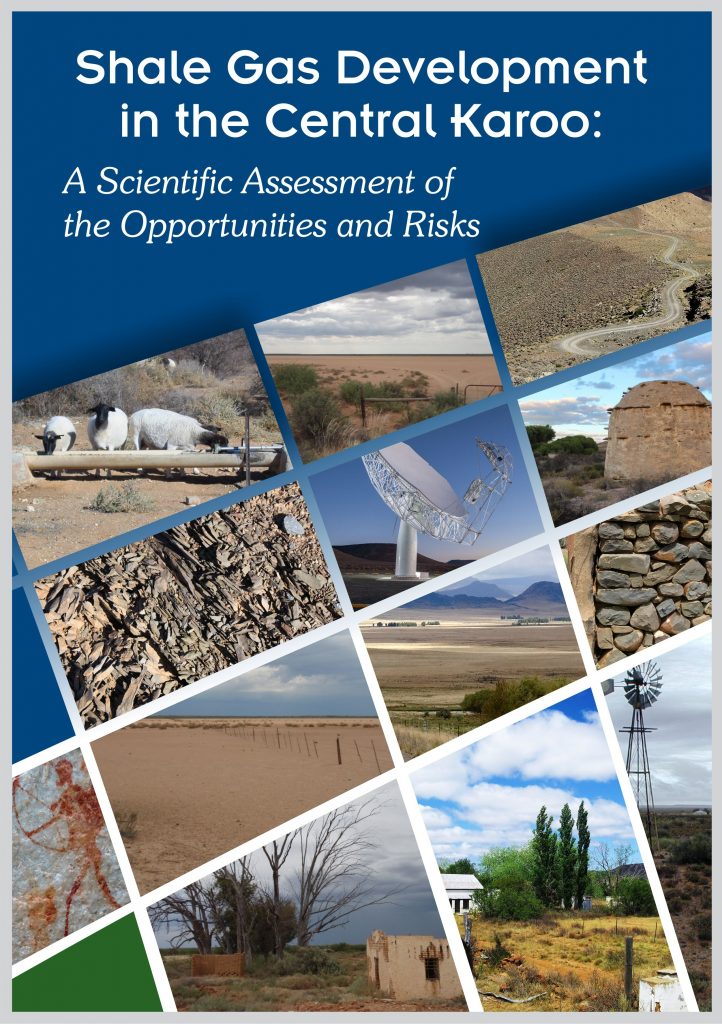

Orderliness in enterprise development in South African towns has been observed as statistically significant correlations between different characteristics of South African towns. One of the first correlations noted was a statistically significant positive relationship between the population of South African towns and the number of their enterprises. This was observed in the Free State, the Northern Cape, the Western Cape (see graph) and the Gouritz Cluster Biosphere Reserve. In fact, towns in the Eastern Cape Karoo exhibited such relationships over a period of a century. One can conclude the relationship is ubiquitous in South Africa.

Orderliness in enterprise development in South African towns has been observed as statistically significant correlations between different characteristics of South African towns. One of the first correlations noted was a statistically significant positive relationship between the population of South African towns and the number of their enterprises. This was observed in the Free State, the Northern Cape, the Western Cape (see graph) and the Gouritz Cluster Biosphere Reserve. In fact, towns in the Eastern Cape Karoo exhibited such relationships over a period of a century. One can conclude the relationship is ubiquitous in South Africa.  Tourism is not a clearly defined industry in the International Standard Industrial Classification of all Economic Activities (ISIC). The key factor in the Tourism Satellite Account for South Africa is to relate purchases by tourists to the total supply of these goods and services. Quantification of tourism enterprise numbers does not form part of the national assessments; yet it was necessary to know how many tourism-related enterprises could be impacted by shale gas production in the study area of the Karoo.

Tourism is not a clearly defined industry in the International Standard Industrial Classification of all Economic Activities (ISIC). The key factor in the Tourism Satellite Account for South Africa is to relate purchases by tourists to the total supply of these goods and services. Quantification of tourism enterprise numbers does not form part of the national assessments; yet it was necessary to know how many tourism-related enterprises could be impacted by shale gas production in the study area of the Karoo.