Johannes Wessels

@johannesEOSA1

Pres Ramaphosa’s announcement that four special ambassadors – including well respected Trevor Manuel – are to roam the globe in an aggressive pursuit of foreign investment “… like a pack of lions”, appears to be premature. It would have helped these ambassadors if they could have had a better story to tell than one of a business environment with stagnating profitability and growing losses where:

- only 25% of firms have earned sufficient to be liable for company tax;

- firms with a taxable income below R10 million decline at a rate of 31 per week;

- a mere 635 companies are responsible for 77% of company tax;

- from 2009 to 2015 company losses as submitted to SARS increased by 85% and for the last two years were higher than the taxable income assessed.

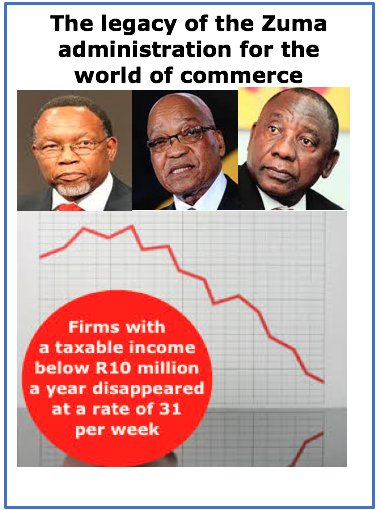

SARS data for tax years 2009 to 2015 (for the latter 95.4% of company tax returns have been assessed) as indicators for the health of the South African enterprise landscape, show the business devastation of the Zuma administration (5 with Motlanthe and 4 with Ramaphosa as deputy). This administration, responsible for mismanaging the macro-environment and overseeing the collapse of the police force and education quality and a rise in crime and corruption, critically damaged the enterprise environment.

In nine years:

- There was no growth in the number of formal enterprises submitting tax returns;

- There was no increase in the number of companies liable for tax;

- The majority of firms (75%) experience poor financial health with either losses in 2015 or loss roll-overs from previous years that swallowed profits;

- The average tax bill per company for those with taxable income in 2015 was 40% higher than in 2009.

SARS already acknowledged that company tax (CIT) shows no real growth. The full picture of how bad the nine years of the Zuma administration really were for business, will only be seen once SARS data for the 2018 tax year become available.

EOSA’s quantitative research (both on SA and US enterprise data) reveal a strong correlation in localities (whether towns and cities, municipalities or counties) between the number of residents and the number of enterprises. Time line studies reveal this correlation remain fairly consistent over time: as the population expand, the number of enterprises grow pro rata. The same also hold at national level. In 2009 (the commencement of the Zuma administration) there were 69.2 residents per firm submitting tax returns. By 2015 that number had increased to 77.4 residents per firm.

This is indicative of a process of impoverishment: more people are required to sustain a firm. It is further indicative of a declining capacity in SA to establish and grow firms that can compete internationally, since enterprises that are primarily exporting do not rely that much on local consumer spending: growth in such firms would have resulted in a lower number of residents per enterprise.

From 2009 – 2015 the population grew by 4.32 million to 55.3 million in 2015 but the businesses submitting tax returns declined by 3% and those that registered taxable income fell by 5%. The tax payments of a declining number of businesses have to (co)-cover an expanding demand for services including:

- social grants

- quotas of free water and electricity

- installation of modern infrastructure and the building of a housing superstructure

- free education (including more primary classrooms and teachers and access to university studies)

- free medical services.

The burden of the deteriorating business environment (more evident amongst SMEs) is captured in the table below.

The following aspects deserve attention:

- The massive shift in the company tax burden (the share of CIT by firms with taxable income above R100 million rose from 69.5% to 77,4% and that of firms with taxable income below R100 million declined by 26%) is indicative of the declining profitability of small and medium firms.

- The fact that 1% of tax paying companies (635 companies in 2015) generate 77% of company taxes is generally interpreted as indicative of insufficient competition. Whilst it is true that SA suffers from high concentration in some sectors, it is contentious to assume that this is caused solely by cartel practices by large companies. There are numerous other factors hindering firms from growing big: electricity constraints; slow and expensive harbours compared to those of main trade partners; ineffective crime prevention; BEE requirements & substantially higher corporate tax rates than those in Mauritius and Botswana that are registering numerous companies of South African entrepreneurs.

To interpret these figures for the timescale that the SARS data covers (6 years), firms with a taxable income of R10 million or less diminished at a rate of 31 firms per week.

SARS data prove the Zuma administration did nothing for SA enterprises to grow: on the contrary, it hampered them with incompetence to combat crime, arbitrarily suspending mining licences, forcing international companies to sell mines to cronies, keeping on bailing out SAA and playing musical chairs games at the Eskom Board of Directors.

Investors normally look at five key considerations before investing:

- Reliable and cost-infrastructure (including bandwidth, ports and airports)

- Labour force stability and comparable productivity levels

- Ease of enterprise operation and a low corporate tax rate

- Low levels of crime and high levels of societal stability

- Policy certainty and protection of property rights.

It is evident from comparing the perceptions of SA business in the 2007 and 2018 Global Competitiveness Reports of the World Economic Forum that South African businesses consider exactly these issues as problematic. In 2007 Labour skills (18.8%), Labour regulations (18.3%), Crime (15.4%) and an Inefficient bureaucracy (11%) were the factors considered as most negative for the business environment. In the last report Government and policy instability & uncertainty (15.5%), Corruption (14.3%), Crime (12%) and Tax rates & regulations (10.2%) were of uttermost concern. Labour regulations registered a low score at 6.3%.

These scores reflect issues considered as most detrimental and it should not be read as if SA has eased labour regulations to enhance economic competitiveness. In fact, the labour regulatory environment has not become easier. By considering therefore private sector’s concern about labour regulations as a constant, one can develop an index scale to assess the extent to which other problems have changed since 2007.

On an index scale:

- Government and policy instability shot up like a rocket: The Mining Charter, Empowerment policies, and Parliament’s unwillingness to support a Chapter 9 institution (Public Protector) are contributing factors;

- Corruption was just beaten into second place: the Zuma administration, Parliament’s unwillingness to call him to account effectively giving a thumbs-up to what was then already well-known practices, wastage of public money, not to mention all the shenanigans at SOE, provincial and municipal levels;

- Crime: if it were an Olympic item, SA would be a strong contender to win gold, silver and bronze;

- Tax rates and regulations: the situation is self-evident;

- Inefficient bureaucracy: Sassa, cushioning incompetence in cabinet, SOEs, municipalities as well as the high costs caused by monopolies like Portnet.

The Zuma legacy ensured several of these essential investor confidence boxes cannot be ticked. The investment ambassadors are now sent out without improvement at these vital levels: money is still poured into non-strategic SOEs, there is no evidence as yet of calling an end to enterprise unfriendly policies and practices. There is however a strong commitment by Ramaphosa about fighting corruption, but as seen before: the wastage caused by corruption are small when compared to the wastage caused by poor policies and bureaucratic incompetence.

Considering Government’s latest investment incentive – Expropriation without Compensation: Potential investors may just be uncertain about the intentions of the pack of lions, not to mention all the hyenas that are still roaming free…

(To receive an email alert of new blogs, scroll down to the bottom of the page and insert your email address)

8 thoughts on “Investment ambassadors can try, but SA company losses exceed taxable income”