Johannes Wessels

@johannesEOSA1

Pres Ramaphosa’s announcement that four special ambassadors – including well respected Trevor Manuel – are to roam the globe in an aggressive pursuit of foreign investment “… like a pack of lions”, appears to be premature. It would have helped these ambassadors if they could have had a better story to tell than one of a business environment with stagnating profitability and growing losses where:

- only 25% of firms have earned sufficient to be liable for company tax;

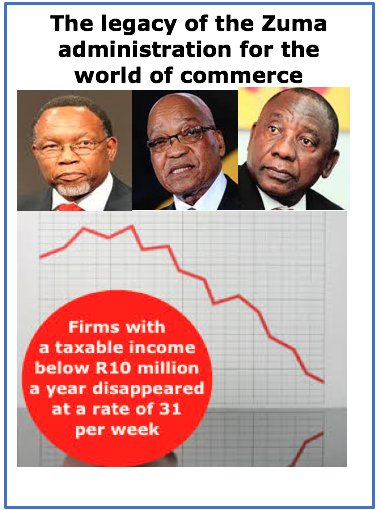

- firms with a taxable income below R10 million decline at a rate of 31 per week;

- a mere 635 companies are responsible for 77% of company tax;

- from 2009 to 2015 company losses as submitted to SARS increased by 85% and for the last two years were higher than the taxable income assessed.

SARS data for tax years 2009 to 2015 (for the latter 95.4% of company tax returns have been assessed) as indicators for the health of the South African enterprise landscape, show the business devastation of the Zuma administration (5 with Motlanthe and 4 with Ramaphosa as deputy). This administration, responsible for mismanaging the macro-environment and overseeing the collapse of the police force and education quality and a rise in crime and corruption, critically damaged the enterprise environment.

Continue reading “Investment ambassadors can try, but SA company losses exceed taxable income”